Unlock Additional Revenue from Credit Advance Services

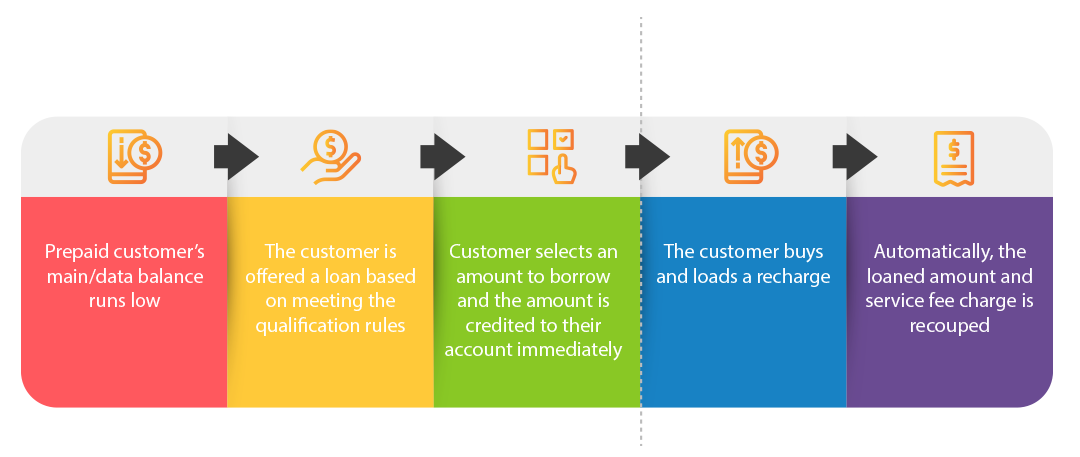

Prepaid credit lending has been a popular Value-Added Service for many years, but it doesn’t get the engagement from customers that it deserves. Many mobile operators offer their qualifying customers the ability to borrow an amount of upfront airtime in emergency situations, with the loaned amount being recovered the next time the customer recharges. A small fixed fee is charged for the loan.

To mitigate the risk that a customer might churn and never repay their loan, operators typically employ strict rules to credit-score the customer for loan eligibility. To qualify to use the service, customers will usually need to have been active on the network for a while and demonstrate usage and top-up behaviours that give confidence that there will be a next recharge forthcoming.

For operators, this can be a lucrative initiative. The availability of the ‘get now – pay later’ service for prepaid customers can keep them connected and able to use their phones in times of need, or whilst they’re waiting for their next pay check, and the total value of fees earned, less any bad-debt from unrecovered loans represents a potentially valuable revenue stream.

Left as a service for ‘emergency use’ however, and with over-restrictive qualifying rules to prevent bad-debt, often leads to only a small percentage of the customer base utilising the service; meaning operators are leaving potential revenue on the table.

In addition to this, limitations in charging systems mean that most operators are only able to effectively provide loan mechanisms for prepaid credit, whilst in today’s economy, the majority of customers prefer to directly purchase volumes of data, minutes and messages in the form of ‘bundles’ or ‘promo-loads’. Specific packages can be loaned to customers, but there can be a significant challenge in recovering the loan automatically if the customer later purchases anything different to the identical package that was borrowed.

The concept of Gamifying your loans service

Powered by Evolution, the next-generation Customer Engagement Platform, Evolving Systems are working with operators to bring a fresh new approach to credit advance utilizing the principles of ‘Gamification’. The gamified lending service developed by Evolving Systems brings financial advantages for any mobile service provider that targets improved revenue. It changes the service from one of ‘emergency’ into one of ‘convenience’, generating higher participation and therefore increased revenue from the fees earned.

Leveraging credit scoring capabilities of the Evolution Platform to drive better decisions, the gamified lending strategy also focuses on incentivizing customers to utilize and engage with the loans service in order to unlock higher loan values as well as other bonuses and benefits. It’s an approach that puts more control for qualification in the customer’s hands.

Through a gamified layer based on points, stars, meters, tiers or any other configurable scoring models that enables progress and recognizes status milestones, the customer can level up their eligibility. For example, take and pay back your borrowed airtime within the next 5 days, you receive 5 stars. Take longer and you get less stars. Leave it longer than 15 days to top-up and your stars balance will decrease! Let’s say you accumulate 75-99 stars, you level up to tier level Sapphire. Once you reach a certain level not only you accumulate stars, but you can use them to unlock higher loans and/or extra rewards.

Coupling this with the ability you have in Evolution to define your own offers out of volumes of telecommunications products such as data, data at certain speeds, data for certain usage types, voice minutes, IDD and messaging that can individually be provisioned to a charging system and you have the capability to lend not only airtime, but also volumes of other products that can be easily recovered on any form of top-up or promo-load made by the customer through Evolution’s configurable workflows.

The service can also extend into other Value-Added Services provided by Communications Service Providers, including Digital Financial Services and Mobile Wallets. Micro-loans with interest charges to help pay a bill until you’re able to add in more cash can be gamified using the same approach.

The value of Gamifying a lending service.

Gamification is proven to create a 1.7x enjoyment lift for participating customers, and over 50% of consumers agree that they engage more with a service when gamification techniques are used. When innovatively applying this approach to an operator’s emergency credit services, we have seen an engagement rate of over 30% of the operator’s prepaid customer base taking and paying back loans, along with a significant reduction in the bad-debt rate. We have also seen this lead to a 10% increase in ARPU from participating customers driven by not only the fees, but also their ability to stay connected and not worry so much about saving their data until their next pay day or plan renewal.

To find out more, reach out and speak to our experts: